2022

13, 2024

26, 2024

| Sincerely, | |||||

| Sarah Boyce | |||||

| President, Chief Executive Officer and Director San Diego, California | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| x | No fee required | ||||

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2022

13, 2024

26, 2024

| Sincerely, | |||||

| Sarah Boyce | |||||

| President, Chief Executive Officer and Director San Diego, California | |||||

To be Held Wednesday, June 15, 2022

AVIDITY BIOSCIENCES, INC.

10578 Science Center Drive, Suite 125, San Diego, California 92121

| To be Held Thursday, June 13, 2024 | ||

AVIDITY BIOSCIENCES, INC. 10578 Science Center Drive, Suite 125, San Diego, California 92121 | ||

|

|

|

|

|

| By Order of the Board of Directors, | |||||

| Sarah Boyce | |||||

| President, Chief Executive Officer and Director San Diego, California | |||||

| April | |||||

| Page | ||||||||

| ||||||||

PROXY STATEMENT

AVIDITY BIOSCIENCES, INC.

10578 Science Center Drive, Suite 125, La Jolla, California 92121

General

| PROXY STATEMENT | ||

AVIDITY BIOSCIENCES, INC. 10578 Science Center Drive, Suite 125, San Diego, California 92121 | ||

| General | ||

13, 2024:

| PROPOSALS | ||

|

|

|

|

|

| RECOMMENDATIONS OF THE BOARD | ||

|

|

|

|

INFORMATION ABOUT THIS PROXY STATEMENT

| INFORMATION ABOUT THIS PROXY STATEMENT | ||

Stockholders sharing an address that are receiving multiple copies of the Internet Notice can request delivery of a single copy of the proxy statement or annual report or Internet Notice by contacting their broker, bank or other intermediary or sending a written request to Avidity Biosciences, Inc. at the above address or by calling (858) 401-7900.

| Questions and Answers about the Annual Meeting of Stockholders | ||

| Who is entitled to vote on matters presented at the Annual Meeting? | ||

What is the difference between being a “Record Holder” and holding shares in “Street Name”?

| What is the difference between being a “Record Holder” and holding shares in “Street Name”? | ||

Am I entitled to vote if my shares are held in “Street Name”?

| Am I entitled to vote if my shares are held in “Street Name”? | ||

How many shares must be present to hold the Annual Meeting?

| How many shares must be present to hold the Annual Meeting? | ||

How can I attend the Annual Meeting of Stockholders?

| How can I attend the Annual Meeting of Stockholders? | ||

attend the annual meetingAnnual Meeting at www.proxydocs.com/RNA and provide the Control Number by 2:00 p.m. Pacific Time on June 13, 2022.11, 2024. After completion of your registration, further instructions, including a unique link to access the annual meeting,Annual Meeting, will be emailed to you.

Will there be a question and answer session during the Annual Meeting?

| Will there be a question and answer session during the Annual Meeting? | ||

What if a quorum is not present at the Annual Meeting?

| What if a quorum is not present at the Annual Meeting? | ||

What does it mean if I receive more than one Internet Notice or more than one set of Proxy Materials?

| What does it mean if I receive more than one Internet Notice or more than one set of Proxy Materials? | ||

How do I vote?

| How do I vote? | ||

|

|

|

|

•Via the Internet: You may vote at www.proxypush.com/RNA, 24 hours a day, seven days a week, by following the instructions provided in the Internet Notice. You will need to use the Control Number included in your Internet Notice, your proxy card or on the instructions that accompanied your proxy materials to vote via the internet.

| ||

|

|

Can I change my vote after I submit my Proxy?

•by submitting a duly executed proxy bearing a later date than your prior proxy;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Corporate Secretary of Avidity prior to or at the Annual Meeting; or

•by voting online at the Annual Meeting.

Who will count the votes?

| Who will count the votes? | ||

What if I do not specify how my shares are to be voted?

| What if I do not specify how my shares are to be voted? | ||

What are broker non-votes and do they count for determining a quorum?

| What are broker non-votes and do they count for determining a quorum? | ||

What is an Abstention and how will votes Withheld and Abstentions be treated?

| What is an Abstention and how will votes Withheld and Abstentions be treated? | ||

How many votes are required forP.C. or (ii) the approval, on an advisory basis, of the proposals to be voted upon and how will Abstentions and Broker Non-Votes be treated?

| How many votes are required for the approval of the proposals to be voted upon and how will Abstentions and Broker Non-Votes be treated? | ||||

| Proposal | Votes Required | Effect of Votes Withheld / Abstentions and Broker Non-Votes | ||||||||||||

Proposal 1: Election of Directors | The plurality of the votes cast. This means that the | Votes withheld and broker non-votes will have no effect. | ||||||||||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the votes cast for or against the matter. | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. | ||||||||||||

Proposal 3: Advisory Approval of the Compensation of Named Executive Officers | The affirmative vote of a majority of the votes cast for or against the matter. | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. | ||||||||||||

| ||||||

Will any other business be conducted at the Annual Meeting?

Where can I find the voting results of the Annual Meeting of Stockholders?

| Where can I find the voting results of the Annual Meeting of Stockholders? | ||

Proposal 1 - Election of Directors

| Proposals to be Voted on | ||||||||||||||

| Proposal 1 - Election of Directors | ||

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the twothree nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

| Name | Age | Position | Independent | Committee Membership | ||||||||||||||||||||||||||||||

| Carsten Boess | 57 | Director | X | Audit (Chair) | ||||||||||||||||||||||||||||||

| Sarah Boyce | 52 | President, Chief Executive Officer, and Director | ||||||||||||||||||||||||||||||||

| Troy Wilson, Ph.D., J.D. | 55 | Chair of the Board | X | |||||||||||||||||||||||||||||||

| CLASS | ||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||

Arthur Levin, Ph.D. | 70 | Distinguished Scientist and Strategic Leader, and Director | ||||||||||||||||||||||||||||||||

| Tamar Thompson | 50 | Director | X | Nominating and Corporate Governance; | ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||

CLASS III DIRECTORS - Terms to Expire at the | ||||||||||||||||||||||||||||||||||

Noreen Henig, M.D. | 59 | Director | X | Nominating and Corporate Governance (Chair); Audit | ||||||||||||||||||||||||||||||

Edward M. Kaye, M.D. | 75 | Director | X | |||||||||||||||||||||||||||||||

Jean Kim | 50 | Director | X | Audit | ||||||||||||||||||||||||||||||

Vote required

Class II Directors (Terms to Expire at the 2025 Annual Meeting)

Erik Mosbrooker has served on our board of directors since August 2021. Since March 2021, Mr. Mosbrooker has served as Chief Operations Officer of Cognoa, Inc. Previously, Mr. Mosbrooker has served as Senior Vice President and Chief Commercial Officer of Audentes Therapeutics, Inc. from January 2019 to January 2021. From August 2018 to December 2018, Mr. Mosbrooker served first as Chief Commercial Officer and later as Chief Operating Officer at Origin Biosciences, a subsidiary of BridgeBio Pharma LLC focused on developing a rare pediatric metabolic disorder treatment. From November 2016 to April 2018, following its acquisition of Raptor Pharmaceuticals Corp, he served at Horizon Pharma plc as Group Vice President and GM and later as Senior Vice President and GM. Prior to the acquisition by Horizon Pharma, Mr. Mosbrooker served in various positions at Raptor Pharmaceuticals from November 2012, including Senior Vice President of Americas & Asia Pacific from March 2016 to November 2016. Prior to Raptor, Mr. Mosbrooker served as commercial operations and market access lead for STRENSIQ® at Alexion Pharmaceuticals, Inc. and Enobia Pharma, Inc. He has held various commercial operational roles at Onyx Pharmaceuticals, Inc., Jazz Pharmaceuticals Inc., Chiron Corporation (now Novartis) and Millennium Pharmaceuticals, Inc. He has experience in management, healthcare and technology consulting at IBM, Teltech Resource Network Corporation and Kohler Company. Mr. Mosbrooker earned his B.S. in Industrial Engineering from the University of Wisconsin, Madison. Mr. Mosbrooker’s executive and commercial experience in the biotechnology industry contributed to our board of directors’ conclusion that he should serve as a director of our company.

Tamar Thompson has served on our board of directors since January 2021. Since November 2019, Ms. Thompson has served as the Vice President, Global Corporate Affairs for Alexion Pharmaceuticals, Inc. and as the Chair of the Board of Alexion’s Charitable Foundation. Prior to joining Alexion, Ms. Thompson served as head, federal executive branch strategy and state government affairs for Bristol-Myers Squibb Company from February 2015 to November 2019. She also served as a strategic policy advisor and consultant for premiere Washington, DC based firms, including ADVI, Kimbell and Associates and Avalere Health. Ms. Thompson holds a M.S. in Health Sciences with a concentration in Public Health from Trident University. Ms. Thompson’s extensive health policy and government affairs experience contributed to our board of directors’ conclusion that she should serve as a director of our company.

Continuing Members of the Board:

Class I Directors (Terms to Expire at the 2024 Annual Meeting)

| Class I Directors (Terms to Expire at the 2027 Annual Meeting) | ||

2.plc. Previously, Mr. Boess was the Executive Vice President of Corporate Affairs at Kiniksa Pharmaceuticals, Ltd. from August 2015 until February 2020. Before Kiniksa, Mr. Boess was the Chief Financial Officer at Alexion Pharmaceuticals from 2004 to 2005 and the Senior Vice President and Chief Financial Officer at Synageva BioPharma Corp. from 2011 until the company’s acquisition by Alexion Pharmaceuticals in 2015. Previously, Mr. Boess served in multiple roles with increasing responsibility at Insulet Corporation, including Chief Financial Officer from 2006 to 2009 and Vice President of International Operations from 2009 to 2011. Prior to that, Mr. Boess served as Executive Vice President of Finance at Serono Inc. from 2005 to 2006. In addition, he was a member of the Geneva-based World Wide Executive Finance Management Team while at Serono. Mr. Boess also held several financial executive roles at Novozymes of North America and Novo Nordisk in France, Switzerland and China. During his tenure at Novo Nordisk, he served on Novo Nordisk’s Global Finance Board. From August 2020 until January 2023, Mr. Boess served on the board of directors of Health Sciences Acquisitions Corporation 2. Mr. Boess received a Bachelor’s degree and Master’s degree in Economics and Finance, specializing in Accounting and Finance from the University of Odense, Denmark. Mr. Boess’Boess’s business, financial and corporate governance experience in the biotechnology industry contributed to our board of directors’ conclusion that he should serve as a director of our company.

Class III

| Class II Directors (Terms to Expire at the 2025 Annual Meeting) | ||

Ms. Thompson has served on the board of directors of Catalyst Pharmaceuticals, Inc., where she is also a member of the audit committee and the nominating and corporate governance commmittee. Ms. Thompson holds a M.S. in Health Sciences with a concentration in Public Health from Trident University. Ms. Thompson’s extensive health policy and government affairs experience contributed to our board of directors’ conclusion that she should serve as a director of our company.

| Class III Directors (Terms to Expire at the 2026 Annual Meeting) | ||

Therapeutics N.V. where she oversaw preclinical and clinical drug development from March 2014 to November 2017. Before joining ProQR, Dr. Henig was Senior Director, Global Respiratory, from 2011 to 2014, and Director, Respiratory Therapeutics, from 2008 to 2011, at Gilead Sciences, Inc. Dr. Henig’s specialties as a physician include pulmonary, critical care, allergy and immunology. Dr. Henig holds an M.D. with a distinction in immunology from the Albert Einstein College of Medicine of Yeshiva University and a B.A. from Yale University. She also completed training in internal medicine at the University of California, San Francisco and in pulmonary and critical care medicine at the University of Washington. Dr. Henig’s drug development and clinical trial experience contributed to our board of directors’ conclusion that she should serve as a director of our company.

Proposal 2 - Ratification of Appointment of Independent Public Accounting Firm

| Proposal 2 - Ratification of Appointment of Independent Public Accounting Firm | ||

In the event that the appointment of BDO USA, LLPP.C. is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent registered public accounting firm for the fiscal year ending December 31, 2023.2025. Even if the appointment of BDO USA, LLPP.C. is ratified, the Audit Committee retains the discretion to appoint a different independent registered public accounting firm at any time if it determines that such a change is in the interest of the Company.

| Independent Registered Public Accountants' Fees | ||

| Fiscal Years Ended December 31, | ||||||||

| Fee Category | 2021 | 2020 | ||||||

Audit Fees(1) | $ | 525,246 | $ | 676,064 | ||||

Audit-Related Fee | — | — | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

|

| |||||||

Total Fees | $ | 525,246 | $ | 676,064 | ||||

|

| |||||||

| Fiscal Years Ended December 31, | ||||||||||||||

| Fee Category | 2023 | 2022 | ||||||||||||

Audit Fees(1) | $ | 692,993 | $ | 598,809 | ||||||||||

| Audit-Related Fee | — | — | ||||||||||||

| Tax Fees | — | — | ||||||||||||

| All Other Fees | — | — | ||||||||||||

| Total Fees | $ | 692,993 | $ | 598,809 | ||||||||||

Audit Committee Pre-Approval of Audit and Non-Audit Services

| Audit Committee Pre-Approval of Audit and Non-Audit Services | ||

| Report of the Audit Committee of the Board | ||

2024.

Proposal 3 - Approval

| Proposal 3 - Advisory Approval of the Compensation of the Named Executive Officers | ||

Proposal 4 - Frequency of Stockholder Vote on Executive Compensation

Under the Dodd-Frank Act, our stockholders are entitled to vote at the Annual Meeting regarding whether the stockholder vote to approve the compensation of our named executive officers as required by Section 14A(a)(2) of the Exchange Act (and as described in Proposal 3 of this proxy statement), should occur every one, two or three years. Under the rules issued by the SEC, stockholders shall also have the option to abstain from voting on the matter. Pursuant to the Dodd-Frank Act, the stockholder vote on the frequency of the stockholder vote to approve executive compensation is an advisory vote only, and it is not binding on us or our Board.

Although the vote is non-binding, our Compensation Committee and Board value the opinions of our stockholders and will consider the outcome of the vote when determining the frequency of the stockholder vote on executive compensation.

Vote Required

If a quorum is present and voting at the Annual Meeting, the alternative receiving the highest number of votes—every one year, every two years or every three years—will be the stockholders’ recommendation, on an advisory basis, of the frequency of the stockholder vote on executive compensation. Abstentions and broker non-votes will be counted only for purposes of determining a quorum. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposal in the absence of voting instructions from the beneficial owner.

The Board unanimously recommends a vote FOR EVERY ONE YEAR regarding the frequency of the stockholder vote to approve the compensation of the named executive officers as required by Section 14(A)(2) of the Exchange Act. Please note: Stockholders are not voting to approve or disapprove our Board’s recommendation regarding this proposal 4.

| Executive Officers | ||

| Name | Age | Position | ||||||||

Sarah Boyce | 52 | President, Chief Executive Officer and Director | ||||||||

W. Michael Flanagan, Ph.D. | 62 | Chief Scientific and Technical Officer | ||||||||

| ||||||||||

Michael F. MacLean | 58 | Chief Financial and Chief Business Officer | ||||||||

Teresa McCarthy | 60 | Chief Human Resources Officer | ||||||||

Arthur A. Levin, Ph.D., has served as our Chief Scientific Officer since October 2019, and prior to that as our Executive Vice President of Research and Development since October 2013. Dr. Levin has a combined three decades of experience in all aspects of drug development from discovery through drug registration and has played key roles in the development of numerous oligonucleotides. From April 2012 to January 2014, he served as Executive Vice President at miRagen Therapeutics, Inc. Prior to that, Dr. Levin held various senior management positions at Santaris Pharma A/S Corp. and Ionis Pharmaceuticals, Inc. Since September 2015, Dr. Levin has served as a member of the board of directors of Stoke Therapeutics, Inc. Dr. Levin holds a Ph.D. in Toxicology from the University of Rochester and a B.S. in Biology from Muhlenberg College.

Michael F. MacLean has served as our Chief Financial Officer since May 2020 and as our Chief Financial and Chief Business Officer since April 2022. Most recently, Mr. MacLean served as Chief Financial Officer of Akcea Therapeutics, Inc. from September 2017 to March 2020. Prior to joining Akcea Therapeutics, from September 2015 to August 2017, Mr. MacLean was Chief Financial Officer and Executive Vice President of PureTech Health plc. Previously, Mr. MacLean was Chief Financial Officer of Iron Mountain Inc.’s North American business from July 2014 to June 2015 and was Senior Vice President, Worldwide Controller at Iron Mountain from October 2012 to June 2014. Prior to Iron Mountain, Mr. MacLean previously served as Senior Vice President of Finance and Chief Accounting Officer of Biogen Inc., where he led the company’s worldwide finance organization. Since June 2021, Mr. MacLean has also served on the board of directors of Verve Therapeutics. Mr. MacLean holds a B.S. in Accounting from Boston College.

| CORPORATE GOVERNANCE | ||

| General | ||

| Board Independence | ||

| Board Diversity and Director Nomination Process | ||

•personal and professional integrity, ethics and values;

•experience in corporate management, such as serving as an officer or former officer of a publicly-held company;

•experience as a board member or executive officer of another publicly-held company;

•strong finance experience;

•diversity of expertise and experience in substantive matters pertaining to our business relative to other boardBoard members;

•diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience;

•experience relevant to our business industry and with relevant social policy concerns; and

•relevant academic expertise or other proficiency in an area of our business operations.

| Total Number of Directors | 8 | |||||||

| Female | Male | |||||||

Directors | 4 | 4 | ||||||

African American or Black | 1 | 0 | ||||||

Asian | 1 | 0 | ||||||

White | 2 | 4 | ||||||

26, 2024)

| Total Number of Directors | 8 | |||||||||||||

| Female | Male | |||||||||||||

| Directors | 4 | 4 | ||||||||||||

| African American or Black | 1 | — | ||||||||||||

| Asian | 1 | — | ||||||||||||

| White | 2 | 4 | ||||||||||||

| Identification and Evaluation of Nominees for Directors | ||

and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our Board with that of obtaining a new perspective or expertise.

Communication from Stockholders

| Communication from Stockholders | ||

| Director Attendance at Annual Meetings | ||

| Board Leadership Structure - Separate Chair | ||

Role of Board in Risk Oversight Process

| Role of Board in Risk Oversight Process | ||

| Board Evaluation | ||

| Code of Ethics | ||

| Policy on Speculative Trading Activities—Anti-Hedging and Pledging Policy | ||

their households, from making short sales in our equity securities; transacting in puts, calls or other derivative securities involving our equity securities, on an exchange or in any other organized market; engaging in hedging transactions; purchasing our securities on margin or pledging our securities as collateral for a loan.

| Attendance by Members of the Board of Directors at Meetings | ||

director.

| COMMITTEES OF THE BOARD OF DIRECTORS | ||

| Name of Director | Audit | Human Capital Management | Nominating and Corporate Governance | |||||||||||||||||||

Carsten Boess | C† | |||||||||||||||||||||

| Tamar Thompson | X | X | ||||||||||||||||||||

| ||||||||||||||||||||||

| ||||||||||||||||||||||

Noreen Henig, M.D. | X | C | ||||||||||||||||||||

Edward M. Kaye, M.D. | C | X | ||||||||||||||||||||

| Jean Kim | X | |||||||||||||||||||||

•appointing our independent registered public accounting firm;

•evaluating the qualifications, independence and performance of our independent registered public accounting firm;

•approving the audit and non-audit services to be performed by our independent registered public accounting firm;

•reviewing the design, implementation, adequacy and effectiveness of our internal accounting controls and our critical accounting policies;

•discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements;

•reviewing, overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

•reviewing with management and our auditors any earnings announcements and other public announcements regarding our results of operations;

•preparing the report that the SEC requires in our annual proxy statement;

•reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics;

•reviewing and evaluating, at least annually, the performance of the audit committee and its members including compliance of the audit committee with its charter.

Our Compensation

| Human Capital Management Committee | ||

The Compensation Committee has retained Radford, a division of Aon Consulting, Inc. (“Radford”), as its independent compensation consultant to advise the Compensation Committee on matters pertaining to director and executive compensation, including advising as to market levels and practices, plan design and implementation, comparable company data, consulting best practices and governance principles, as well as on matters related to employee equity compensation. Radford does not provide any other services to the Company.

The Compensation Committee has determined, and Radford has affirmed, that Radford’s work does not present any conflicts of interest and that Radford is independent. In reaching these conclusions, the Compensation Committee considered the factors set forth in Exchange Act Rule 10C-1 and Nasdaq listing standards.

The members of our compensation committeeHuman Capital Management Committee are Dr. Kaye Mr. Mosbrooker and Ms. Thompson. Dr. Kaye serves as the ChairpersonChair of the committee. Our Board has determined that each member of this committee is independent under the applicable rules and regulations of Nasdaq and is a “non-employee“non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The Human Capital Management Committee met four times during 2023.

Interlocks and Insider Participation

Nominating and Corporate Governance Committee

Human Capital Management Committee.

| Nominating and Corporate Governance Committee | ||

Compensation Discussion and Analysis

2023.

| COMPENSATION DISCUSSION AND ANALYSIS | ||

•Sarah Boyce, President and Chief Executive Officer

•Michael F. MacLean, Chief Financial and Chief Business Officer

•W. Michael Flanagan, Ph.D., Chief Scientific and Technical Officer

•Teresa McCarthy, Chief Human Resources Officer

Joseph Baroldi, former(1)In February 2023, Dr. Levin transitioned from his role as our Chief OperatingScientific Officer

Jae B. Kim, M.D., former Chief Medical Officer

Overview of 2021 Executive Compensation Decisions

| Overview of 2023 Executive Compensation Decisions | ||

•The performance measures in our short-term cash incentive program are linked to key corporate objectives;

Corporate achievement represents 100% of the•Our named executive officers' annual bonus opportunity for eachis dependent entirely on corporate achievement of our named executive officers;performance goals and

Market-Based Base Salary Increases for NEOs | •Our named executive officers received base salary increases for | |||||

Annual Cash Incentives Paid Based on | •Based on our achievement •Our named executive officers' annual incentives tied to corporate performance are subject to further adjustment based on individual performance, as determined by our Human Capital Management Committee on a case-by-case basis, with the resulting individual performance multiplier, if any, applied to determine the final annual incentive payout. | |||||

Long-Term Incentive Compensation | •Our named executive officers receive annual awards of stock options and, commencing in 2023, RSUs, each of which vest over four year periods. •Stock options are an important vehicle for tying executive pay to performance, because they deliver future value only if the value of our common stock increases above the exercise price. As a result, they provide strong incentives for our executive officers to increase the value of our common stock over the long term, and they tightly align the interests of our executives with those of our stockholders. •RSU awards are granted because they are less dilutive to our stockholders, as fewer shares of our common stock are granted to achieve an equivalent value relative to stock options, and because RSU awards are an effective retention tool that maintain value even in cases where the share price is trading lower than the initial grant price. •In September 2023, the Human Capital Management Committee approved special equity awards of options and awards of PSUs to our named executive officers other than Dr. Levin. These special equity awards were intended by the Human Capital Management Committee to serve as special retention and incentive awards, given that the tumultuous market conditions had resulted in our named executive officers’ equity awards having considerably reduced retention value. The Human Capital Management Committee made this determination after consideration of the recommendations of Alpine regarding the role of such awards in retaining the named executive officers, including a review of the equity holdings of the named executive officers and the fact that a significant portion of stock options held by the named executive officers had exercise prices in excess of our common stock price at the time. •In order to address these retention concerns and align executive incentives with long-term value creation, the Human Capital Management Committee determined to grant our named executive officers other than Dr. Levin stock options and PSUs. The number of stock options granted was equal to 50% of the portion of the annual grants for 2023. These stock options represented an advance on the portion of their 2024 annual awards granted in January 2024 in the form of stock options, which January 2024 awards were reduced accordingly to take into account the September 2023 option awards. •Each named executive officer other than Dr. Levin also received a number of PSUs intended to approximate their annual target equity award value (if such awards were granted solely in the form of full value awards). The stock options granted in September 2023 vest in accordance with the standard vesting schedule described above. The PSUs vest in four equal tranches based on achievement of two key clinical development goals related to our delpacibart etedesiran, or del-desiran (formerly AOC 1001), and AOC 1020 candidates, each of which must be achieved prior to September 11, 2025. | |||||

| WHAT WE DO | ||

✓Pay for Performance. We design our executive compensation program to align pay with company performance. | ||

✓Significant Portion of Compensation is at Risk. Under our executive compensation program, a significant portion of compensation is “at risk” based on our performance, including short-term cash incentives and | ||

✓Independent Compensation Committee. The directors. | ||

✓Independent Compensation Advisor Reports Directly to the | ||

✓Annual Market Review of Executive Compensation. The consultant annually assess competitiveness and market alignment of our compensation plans and practices. | ||

✓Multi-Year or Performance Vesting Requirements. The equity awards granted to our executive officers vest over multi-year periods or based on performance goals tied to key corporate objectives, consistent with current market practice and our retention objectives. | ||

✓Minimize Inappropriate Risk Taking. Our compensation program is weighted toward long-term incentive compensation to discourage short-term risk taking, and it includes goals that are quantifiable with objective criteria, multiple performance measures and caps on short-term incentive compensation. | ||

✓“Double Trigger” Change in Control Cash Severance Benefits. The employment agreements with our named executive officers do not include any “single trigger” change in control cash severance benefits. | ||

✓Competitive Peer Group. Our pharmaceutical companies that are similar to us with respect to market capitalization, revenue, headcount, commercialization stage, and geographic region, while also taking into account a number of qualitative criteria. | ||

✓ Clawback Policy. We maintain a clawback policy as required by SEC and Nasdaq rules to recover erroneously awarded incentive compensation from our current and former executive officers in the event of an accounting restatement. | ||

| WHAT WE DON’T DO | ||

X No Special Health or Welfare Benefits for Executives. Our executive officers participate in broad-based, company-sponsored health and welfare benefits programs on the same basis as our other employees. Executives do not have access to special benefits programs. | ||

X No Post-Employment Tax Gross-Ups. We do not provide any post-employment tax reimbursement payments (including | ||

X officers) and directors from engaging in hedging or short-term speculative transactions involving our securities. | ||

Compensation Philosophy and Objectives

| Compensation Philosophy and Objectives | ||

•To attract, engage and retain an executive team who will provide leadership for our future success by providing competitive total pay opportunities.

•To establish a direct link between our business results, individual executive performance and total executive compensation.

•To align the interests of our executive officers with those of our stockholders.

approve.

Radford

2023.

MARKET CAPITALIZATION | •Generally between •Our market capitalization was positioned near the | |||||

SECTOR AND STAGE | • organizations. •Emphasis on companies possible. •Emphasis on Phase 1 to | |||||

HEADCOUNT | • Companies with generally fewer than | |||||

GEOGRAPHIC LOCATION | •Focused on West Coast or other biotech “hub” locations that reflect our talent market. | |||||

| Arcturus Therapeutics | Morphic Therapeutic | |||||

| NGM Biopharmaceuticals | ||||||

| Dyne Therapeutics | ||||||

| Editas Medicine | PMV Pharmaceuticals | |||||

| Erasca, Inc. | Prometheus Biosciences | |||||

| Gossamer Bio | RAPT Therapeutics | |||||

| IGM Biosciences | Stoke Therapeutics | |||||

| Janux Therapeutics | Vaxcyte | |||||

| Kura Oncology | Verve Therapeutics | |||||

| Kymera Therapeutics | ||||||

| Zentalis Pharmaceuticals | ||||||

Executive Compensation Components

| Executive Compensation Components | ||

goals.

Named Executive Officer | 2021 Base Salary | Percentage Increase from 2020 | ||||||

Sarah Boyce | $ | 570,000 | 9.6 | % | ||||

Michael F. MacLean | $ | 420,000 | 6.6 | % | ||||

W. Michael Flanagan, Ph.D. | $ | 400,000 | N/A | (1) | ||||

Arthur A. Levin, Ph.D. | $ | 432,400 | 4.4 | % | ||||

Joseph Baroldi | $ | 439,900 | 3.5 | % | ||||

Jae B. Kim, M.D. | $ | 455,400 | 3.5 | % | ||||

|

____________________Named Executive Officer Sarah Boyce $ 634,500 5.5 % Michael F. MacLean $ 471,900 4.5 % $ 470,600 11.5 % $ 250,000 (45.0) % Teresa McCarthy $ 439,300 4.5 %

2022. The compensation committeeactual bonuses awarded in any year, if at all, may be more or less than the beginningtarget, depending on the achievement of corporate objectives.

Accordingly, this 100% achievement level was applied to each executive's target bonus level.

| 2023 Corporate Performance Goals | ||

All of our named executive officers’ annual bonus payouts are tied to performance relative to the corporate goals set by our board of directors.

2021 Corporate Performance Goals

The 20212023 performance goals were set at levels such that the attainment of executive target annual cash incentive award opportunities was not assured at the time they were established and would require a high level of effort and execution on the part of the executive officers and others in order to achieve the goals. The compensation committeeHuman Capital Management Committee also specified a “stretch” weighting for certain clinical goals, corresponding to additional credit that could be achieved

for those goals in the event of over performance in that area, generally representing up to an additional 50% in the aggregate of the target level for the corporate goals.

This overall 130%those goals. Accordingly, this 100% achievement level was then usedapplied to determine each named executive officer’s bonus. target bonus level.

Human Capital Management Committee.

employment generally vest as to 25% of the award on the first anniversary of the vesting commencement date, with the remainder vesting in equal monthly installments over a three-year period thereafter. Option awards granted as part of our ongoing, annual award program generally vest in equal monthly installments over a four-year period. From time to time, our compensation committeeHuman Capital Management Committee may, however, determine that a different vesting schedule is appropriate.

2021

In February 2021, the compensation committee approved theordinary course annual equity awards for our named executive officers with 100%approximately 80% of the total value of the awards allocated in the form of options.options and 20% in the form of RSUs. The equity awards granted to our named executive officers for 20212023 are set forth in the “Grants of Plan-Based Awards Table”Awards" table below, each of which vests over four years in accordance with the standard vesting schedules described above.

to be granted to our non-employee directors, which stock options will vest on the first anniversary of the grant date (or, if earlier, our next annual meeting of stockholders), subject to his continued service through the vesting date. The awards to Dr. Levin will also vest in the event of a change in control. In the event the value of the award to Dr. Levin would exceed the foregoing valuation cap, as calculated on the grant date in accordance with the Black-Scholes option pricing model (utilizing the same assumptions we utilize in preparation of our financial statements and the average closing price per share of our common stock for the 30-day period preceding the grant date), then the number of shares of our common stock underlying such grant will be reduced by a number necessary to ensure the value of such grant equals or falls below the limit.

named executive officers. We have, however, agreed to pay relocation assistance benefits to Mr. MacLean, Dr. Flanagan and Dr. Kim in connection with their relocation to the San Diego area.

Prohibition on Certain Transactions in Avidity Securities

| Prohibition on Certain Transactions in Avidity Securities | ||

Reportreceived by our current and former executive officers on or after October 2, 2023. As set forth in the Clawback Policy, if such compensation is later determined to have been erroneously awarded in the event of Compensationan accounting restatement of our financial statements, the Human Capital Management Committee is required to administer the recovery of the Boardapplicable compensation. Persons covered under the Clawback Policy are not entitled to indemnification in connection with enforcement of Directors

the Clawback Policy. Each of our named executive officers has executed an acknowledgment agreement conditioning receipt of compensation on adherence to the Clawback Policy.

| Compensation Committee Report | ||

Human Capital Management Committee.

Eric Mosbrooker

(Chair)

2021 Summary Compensation Table

| COMPENSATION TABLES | ||

| 2023 Summary Compensation Table | ||

Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($)(2) | Non-equity incentive plan compensation ($)(3) | All other compensation ($)(4) | Total ($) | |||||||||||||||||||||||||||||||||||||

| Sarah Boyce | 2023 | 634,500 | — | 10,140,840 | 349,000 | 15,379 | 11,139,719 | |||||||||||||||||||||||||||||||||||||

| President and Chief Executive Officer | 2022 | 601,400 | — | 4,319,275 | 430,100 | 15,336 | 5,366,111 | |||||||||||||||||||||||||||||||||||||

| 2021 | 570,000 | — | 4,847,250 | 407,600 | 26,461 | 5,851,311 | ||||||||||||||||||||||||||||||||||||||

| Michael F. MacLean | 2023 | 471,900 | — | 3,801,386 | 188,760 | 14,082 | 4,476,128 | |||||||||||||||||||||||||||||||||||||

| Chief Financial and Chief Business Officer | 2022 | 451,500 | — | 1,333,894 | 234,800 | 15,336 | 2,035,530 | |||||||||||||||||||||||||||||||||||||

| 2021 | 420,000 | — | 1,486,490 | 218,400 | 11,984 | 2,136,874 | ||||||||||||||||||||||||||||||||||||||

| W. Michael Flanagan, Ph.D. | 2023 | 470,600 | — | 4,210,742 | 188,240 | 16,379 | 4,885,962 | |||||||||||||||||||||||||||||||||||||

| Chief Scientific and Technical Officer | 2022 | 422,000 | — | 1,387,250 | 241,400 | 15,336 | 2,065,986 | |||||||||||||||||||||||||||||||||||||

| 2021 | 377,436 | 350,000 | 2,918,100 | 208,000 | 67,116 | 3,920,652 | ||||||||||||||||||||||||||||||||||||||

Arthur A. Levin, Ph.D.(5) | 2023 | 250,000 | — | 2,721,838 | 50,000 | 4,687 | 3,026,525 | |||||||||||||||||||||||||||||||||||||

| Distinguished Scientist and Strategic Leader and former Chief Scientific Officer | 2022 | 451,900 | — | 1,173,827 | 235,000 | 15,336 | 1,876,063 | |||||||||||||||||||||||||||||||||||||

| 2021 | 432,400 | — | 1,938,900 | 224,900 | 5,556 | 2,601,756 | ||||||||||||||||||||||||||||||||||||||

| Teresa McCarthy | 2023 | 439,300 | — | 3,097,607 | 175,720 | 13,766 | 3,726,393 | |||||||||||||||||||||||||||||||||||||

| Chief Human Resources Officer | 2022 | 420,300 | — | 1,600,673 | 229,500 | 15,336 | 2,265,809 | |||||||||||||||||||||||||||||||||||||

Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Option awards ($)(3) | Non-equity incentive plan compensation ($)(4) | All other compensation ($)(5) | Total ($) | |||||||||||||||||||||

Sarah Boyce | 2021 | 570,000 | — | 4,847,250 | 407,600 | 26,461 | 5,851,311 | |||||||||||||||||||||

President and Chief | 2020 | 484,256 | — | — | 338,000 | 837 | 823,093 | |||||||||||||||||||||

| 2019 | 103,512 | — | 4,295,649 | 50,630 | 117 | 4,449,908 | ||||||||||||||||||||||

Michael F. MacLean | 2021 | 420,000 | — | 1,486,490 | 218,400 | 11,984 | 2,136,874 | |||||||||||||||||||||

Chief Financial and Chief | 2020 | 247,765 | — | 1,857,763 | 129,200 | 488 | 2,235,216 | |||||||||||||||||||||

W. Michael Flanagan, Ph.D. Chief Technical Officer | 2021 | 377,436 | 350,000 | 2,918,100 | 208,000 | 67,116 | 3,920,652 | |||||||||||||||||||||

Arthur A. Levin, Ph.D. | 2021 | 432,400 | — | 1,938,900 | 224,900 | 5,556 | 2,601,756 | |||||||||||||||||||||

Chief Scientific Officer | 2020 | 414,026 | — | 761,480 | 215,300 | 150 | 1,390,956 | |||||||||||||||||||||

| 2019 | 394,311 | — | — | 148,000 | 702 | 543,013 | ||||||||||||||||||||||

Joseph Baroldi Former Chief Operating Officer | 2021 | 439,900 | — | 1,405,703 | 188,400 | 14,133 | 2,048,136 | |||||||||||||||||||||

Jae B. Kim, M.D. | 2021 | 315,817 | — | 1,831,880 | — | 799,447 | 2,947,144 | |||||||||||||||||||||

Former Chief Medical Officer | 2020 | 191,795 | 50,000 | (6) | 7,015,223 | 98,500 | 349 | 7,335,867 | ||||||||||||||||||||

| 2023 Grants of | ||

|

|

|

|

|

2021 Grants of Plan-Based Awards

The following table sets forth summary information regarding grants of plan-based awards made to our named executive officers during the year ended December 31, 2021.

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | All Other Option Awards: Number of Securities Underlying Options (#)(2) | Exercise or Base Price of Option Awards ($/sh) | Grant Date Fair Value of Stock and Option Awards ($)(3) | |||||||||||||||||||||

Name | Approval Date | Grant Date | Target ($) | |||||||||||||||||||||

Sarah Boyce | — | — | 313,500 | — | — | — | ||||||||||||||||||

| 2/2/2021 | 2/2/2021 | — | 300,000 | 22.34 | 4,847,250 | |||||||||||||||||||

Michael F. MacLean | — | — | 168,000 | — | — | — | ||||||||||||||||||

| 2/2/2021 | 2/2/2021 | — | 92,000 | 22.34 | 1,486,490 | |||||||||||||||||||

W. Michael Flanagan, Ph.D. | — | — | 150,795 | — | — | — | ||||||||||||||||||

| 1/21/2021 | 1/21/2021 | — | 150,000 | 26.75 | 2,918,100 | |||||||||||||||||||

Arthur A. Levin, Ph.D. | — | — | 172,960 | — | — | — | ||||||||||||||||||

| 2/2/2021 | 2/2/2021 | — | 120,000 | 22.34 | 1,938,900 | |||||||||||||||||||

Joseph Baroldi | — | — | 175,960 | — | — | — | ||||||||||||||||||

| 2/2/2021 | 2/2/2021 | — | 87,000 | 22.34 | 1,405,703 | |||||||||||||||||||

Jae B. Kim, M.D. | — | — | 182,160 | — | — | — | ||||||||||||||||||

| 2/2/2021 | 2/2/2021 | — | 82,000 | 22.34 | 1,831,880 | |||||||||||||||||||

|

____________________ (1)Represents the target annual bonus payouts pursuant to our annual bonus program, as described above. (2)Represents PSUs granted to the NEOs (aside from Dr. Levin) that vest in four equal tranches based on achievement of two key clinical development goals related to our del-desiran and AOC 1020 product candidates, each of which must be achieved prior to September 11, 2025. In addition to any accelerated vesting that the executive may be entitled to pursuant to their respective employment agreement, as described in “—Employment Agreements with Our Named Executive Officers” below, the PSUs are eligible to vest in full upon a change in control. (3)Represents RSUs that vest in equal annual installments on each of the first four anniversaries of the grant date, subject to the individual’s continued service through each vesting date. In addition, the employment agreements with our NEOs provide for accelerated vesting under certain circumstances. For additional discussion, please see “—Employment Agreements with Our Named Executive Officers” below. The RSUs that were granted on January 20, 2023 were approved by our Human Capital Management Committee on January 18, 2023. 35 (4)Represents stock options that vest and become exercisable in equal monthly installments over the four-year period following the grant date (5)Represents the grant date fair value of the stock and option awards granted in 2023. In accordance with SEC rules, this column reflects the aggregate fair value of the awards granted to the NEOs computed as of the applicable grant date in accordance with ASC 718. Assumptions used in the calculation of these amounts are included in Notes 2 and 8 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 28, 2024. This amount does not reflect the actual economic value that will be realized by the NEOs upon the vesting or exercise of the awards or the sale of the common stock underlying such awards.

Below are written descriptions of our employment agreements with each of our NEOs. Each of our NEOs’ employment is “at will” and may be terminated at any time. Employment Agreement with Ms. Boyce We have entered into an employment agreement with Ms. Boyce, which governs the terms of Ms. Boyce’s employment. Ms. Boyce serves as our President and Chief Executive Officer. Ms. Boyce’s agreement sets forth her annual base salary and eligibility to receive an annual performance bonus with a target amount of 55% of her base salary. Regardless of the manner in which Ms. Boyce’s employment terminates, she is entitled to receive amounts previously earned during her employment, including unpaid salary and cash out of unused vacation. In addition, Ms. Boyce is entitled to certain severance benefits under her employment agreement, subject to her execution of a release of claims and compliance with post-termination obligations. Ms. Boyce’s employment agreement provides for severance benefits for certain terminations that arise during and outside a change of control period. Upon a termination without cause or resignation for good reason outside of a change of control period (as such terms are defined below), Ms. Boyce is entitled to: (i) continuation of her base salary for 12 months (such applicable period, the severance period), and (ii) payment of the COBRA premiums for her and her eligible dependents until the earliest of (a) the end the severance period, (b) expiration of her eligibility for continuation coverage under COBRA, or (c) the date she becomes eligible for health insurance coverage in connection with her new employment. Upon a termination without cause or resignation for good reason within 59 days prior to or 12 months after a change of control (such period, the change of control period), Ms. Boyce is entitled to: (i) continuation of her base salary for 18 months, (ii) an amount equal to her target annual bonus for the year in which the termination occurs, paid in a lump sum, (iii) payment of the COBRA premiums for her and her eligible dependents until the earliest of (a) the end such 18-month period, (b) expiration of her eligibility for continuation coverage under COBRA, or (c) the date she becomes eligible for health insurance coverage in connection with her new employment, and (iv) accelerated vesting of any unvested time-based vesting equity awards. For purposes of Ms. Boyce’s employment agreement: •“cause” means (i) executive’s willful failure substantially to perform executive’s duties and responsibilities to us or deliberate violation of our policy; (ii) executive’s commission of any act of fraud, embezzlement, dishonesty or any other willful misconduct that has caused or is reasonably expected to result in material injury to us; (iii) executive’s unauthorized use or disclosure of any proprietary information or trade secrets of ours or any other party to whom executive owes an obligation of nondisclosure as a result of executive’s relationship with us; or (iv) executive’s willful breach of any of executive’s obligations under any written agreement or covenant with us; •“change of control” has the same meaning given to such term in our 2020 Plan; and •“good reason” means executive’s resignation from employment with us if we take any of the following actions without executive’s prior written consent: (i) a material reduction in executive’s base salary, 36 unless pursuant to a salary reduction program applicable generally to our similarly situated employees; (ii) a material reduction in executive’s duties, including responsibilities and/or authorities, provided that it shall not constitute good reason if such reduction is a mere change of title alone or change in reporting relationship; (iii) relocation of executive’s principal place of employment to a place that increases executive’s one-way commute by more than 50 miles as compared to executive’s then-current principal place of employment immediately prior to such relocation; or (iv) any other action or inaction that constitutes a material breach by us of any agreement under which executive provides services.

sets forth his annual base salary and eligibility to receive an annual performance bonus with a target amount of 40% of his base salary. Mr. MacLean is also eligible for relocation assistance in connection with his relocation to the San Diego, California area. In addition, if Mr. MacLean is terminated by us without cause or he resigns for good reason (as such terms are defined below) within one year following his relocation, we will pay for his relocation back to Massachusetts (in an amount not to exceed the initial relocation reimbursement provided by us). Regardless of the manner in which his service terminates, Mr. MacLean is entitled to receive amounts previously earned during his term of service, including unpaid salary and cash out of unused vacation. In addition, Mr. MacLean is entitled to certain severance benefits under his employment agreement, subject to his execution of a release of claims and compliance with post-termination obligations. Mr. MacLean’s employment agreement provides for severance benefits for certain terminations that arise during and outside a change of control period. Upon a termination without cause or resignation for good reason outside of a change of control period (as such terms are defined below), Mr. MacLean is entitled to: (i) continuation of his base salary for 12 months (such applicable period, the severance period), (ii) payment of the COBRA premiums for him and his eligible dependents until the earliest of (a) the end the severance period, (b) expiration of his eligibility for continuation coverage under COBRA, or (c) the date he becomes eligible for health insurance coverage in connection with his new employment, and (iii) any vested equity awards remaining exercisable. Upon a termination without cause or resignation for good reason within 59 days prior to or 12 months after a change of control (such period, the change of control period), Mr. MacLean is entitled to: (i) continuation of his base salary for 12 months, (ii) an amount equal to his target annual bonus for the year in which the termination occurs, paid in a lump sum, (iii) payment of the COBRA premiums for him and his eligible dependents until the earliest of (a) the end of such 12-month period, (b) expiration of his eligibility for continuation coverage under COBRA, or (c) the date he becomes eligible for health insurance coverage in connection with his new employment, and (iv) accelerated vesting of any unvested time-based vesting equity awards and any vested equity awards remaining exercisable. For purposes of Mr. MacLean’s employment agreement: •“cause” means (i) executive’s willful failure substantially to perform executive’s duties and responsibilities to us causing material harm to us after written notice to executive specifying such failure and executive’s failure to cure within 60 days or deliberate violation of our written policy causing material harm to us; (ii) executive’s commission of any act of fraud, embezzlement, dishonesty or any other willful misconduct that has caused or is reasonably expected to result in material injury to us; (iii) executive’s unauthorized use or disclosure of any proprietary information or trade secrets of ours or any other party to whom executive owes an obligation of nondisclosure as a result of executive’s relationship with us; or (iv) executive’s willful breach of any of executive’s obligations under any written agreement or covenant with us; •“change of control” has the same meaning as given to the term in Ms. Boyce’s employment agreement, as described above; and •“good reason” means executive’s resignation from employment with us if we take any of the following actions without executive’s prior written consent: (i) a material reduction in executive’s base salary, 37 unless pursuant to a salary reduction program applicable to our executive team at the same reduction percentage; (ii) a material reduction in executive’s duties (including responsibilities and/or authorities) or requirement that executive reports to someone other than our Chief Executive Officer; provided that it shall not constitute good reason if such reduction is a mere change of title alone; (iii) relocation of executive’s principal place of employment to a place that increases executive’s one-way commute by more than 50 miles as compared to executive’s then-current principal place of employment immediately prior to such relocation; or (iv) any other action or inaction that constitutes a material breach by us of any agreement under which executive provides services. Employment Agreement with Dr. Flanagan We have entered into an employment agreement with Dr. Flanagan, which sets forth the terms of Dr. Flanagan’s employment. Dr. Flanagan serves as our Chief Dr. Flanagan also received a $350,000 signing bonus in connection with his commencement of employment. In 2021, Dr. Flanagan received a relocation reimbursement payment of $36,429, plus $16,037 in tax gross-ups on such portion of the relocation benefits that were taxable to him. Dr. Flanagan is not eligible for reimbursement payments in addition to the amounts already paid to him. Regardless of the manner in which his service terminates, Dr. Flanagan is entitled to receive amounts previously earned during his term of service, including unpaid salary and cash out of unused vacation. In addition, Dr. Flanagan is entitled to certain severance benefits under his employment agreement, subject to his execution of a release of claims and compliance with post-termination obligations. Dr. Flanagan’s employment agreement provides for severance benefits for certain terminations that arise during and outside a change of control period. Upon a termination without cause or resignation for good reason outside of a change of control period (as such terms are defined below), Dr. Flanagan is entitled to: (i) continuation of his base salary for 12 months (such applicable period, the severance period), and (ii) payment of the COBRA premiums for him and his eligible dependents until the earliest of (a) the end the severance period, (b) expiration of his eligibility for continuation coverage under COBRA, or (c) the date he becomes eligible for health insurance coverage in connection with his new employment. Upon a termination without cause or resignation for good reason within 59 days prior to or 12 months after a change of control (such period, the change of control period), Dr. Flanagan is entitled to: (i) continuation of his base salary for 12 months, (ii) an amount equal to his target annual bonus for the year in which the termination occurs, paid in a lump sum, (iii) payment of the COBRA premiums for him and his eligible dependents until the earliest of (a) the end of such 12-month period, (b) expiration of his eligibility for continuation coverage under COBRA, or (c) the date he becomes eligible for health insurance coverage in connection with his new employment, and (iv) accelerated vesting of any unvested time-based vesting equity awards. For purposes of Dr. Flanagan’s employment agreement: •“cause” has the same meaning as given to the term in Ms. Boyce’s employment agreement, as described above; •“change of control” has the same meaning as given to the term in Ms. Boyce’s employment agreement, as described above; and •“good reason” means executive’s resignation from employment with us if we take any of the following actions without executive’s prior written consent: (i) a material reduction in executive’s base salary, 38 unless pursuant to a salary reduction program applicable generally to our similarly situated employees; (ii) a material reduction in executive’s duties, including responsibilities and/or authorities, provided that it shall not constitute good reason if such reduction is a mere change of title alone or change in reporting relationship; (iii) relocation of executive’s principal place of employment to a place that increases executive’s one-way commute by more than 50 miles as compared to executive’s then-current principal place of employment immediately prior to such relocation; or (iv) any other action or inaction that constitutes a material breach by us of any agreement under which executive provides services. Employment Agreement with Ms. McCarthy We have entered into an employment agreement with Ms. McCarthy, which sets forth the terms of her employment. Ms. McCarthy serves as our Chief Human Resources Officer. Ms. McCarthy’s agreement sets forth her annual base salary and eligibility to receive an annual performance bonus with a target amount of 40% of her base salary of her then-current annual base salary. Regardless of the manner in which her service terminates, Ms. McCarthy is entitled to receive amounts previously earned during her term of service, including unpaid salary and cash out of unused vacation. In addition, Ms. McCarthy is entitled to certain severance benefits under her employment agreement, subject to her execution of a release of claims and compliance with post-termination obligations. Ms. McCarthy’s employment agreement provides for severance benefits for certain terminations that arise during and outside a change of control period. Upon a termination without cause or resignation for good reason outside of a change of control period (as such terms are defined below), Ms. McCarthy is entitled to: (i) continuation of her base salary for 12 months (such applicable period, the severance period), and (ii) payment of the COBRA premiums for her and her eligible dependents until the earliest of (a) the end the severance period, (b) expiration of her eligibility for continuation coverage under COBRA, or (c) the date she becomes eligible for health insurance coverage in connection with her new employment. Upon a termination without cause or resignation for good reason within 59 days prior to or 12 months after a change of control (such period, the change of control period), Ms. McCarthy is entitled to: (i) continuation of her base salary for 12 months, (ii) an amount equal to her target annual bonus for the year in which the termination occurs, paid in a lump sum, (iii) payment of the COBRA premiums for her and her eligible dependents until the earliest of (a) the end of such 12-month period, (b) expiration of her eligibility for continuation coverage under COBRA, or (c) the date she becomes eligible for health insurance coverage in connection with her new employment, and (iv) accelerated vesting of any unvested time-based vesting equity awards. For purposes of Ms. McCarthy’s employment agreement: •“cause” has the same meaning as given to the term in Ms. Boyce’s employment agreement, as described above; •“change of control” has the same meaning as given to the term in Ms. Boyce’s employment agreement, as described above; and •“good reason” means executive’s resignation from employment with us if we take any of the following actions without executive’s prior written consent: (i) a material reduction in executive’s base salary, unless pursuant to a salary reduction program applicable generally to our similarly situated employees; (ii) a material reduction in executive’s duties, including responsibilities and/or authorities, provided that it shall not constitute good reason if such reduction is a mere change of title alone or change in reporting relationship; (iii) relocation of executive’s principal place of employment to a place that increases

Employment Agreement with

In connection with his transition from serving as our Chief Scientific Officer to the role of Distinguished Scientist and Strategic Leader and serving on our Board, we entered into an amended and restated employment agreement with

39 $250,000 and may receive a discretionary annual bonus. Dr. Levin is not entitled to any additional compensation for his service Dr. Levin is not entitled to

The following table sets forth specified information regarding the outstanding equity awards held by our named executive officers at December 31,

____________________ (1)The stock options vest and become exercisable in equal monthly installments over the four-year period following the vesting commencement date until fully vested at the fourth anniversary of the vesting commencement date, subject to the individual’s continued service through each vesting date. In addition, the employment agreements with our NEOs provide for accelerated vesting under certain circumstances. For additional discussion, please see “—Employment Agreements with Our Named Executive Officers” above. (2)The stock options vest and become exercisable with respect to 25% of the underlying shares on the one-year anniversary of the vesting commencement date and monthly thereafter in equal installments until fully vested at the fourth anniversary of the vesting commencement date, subject to the individual’s continued service through each vesting date. In addition, the employment agreements with our NEOs provide for accelerated vesting under certain circumstances. For additional discussion, please see “—Employment Agreements with Our Named Executive Officers” above. 40

(1)The stock options vest and become exercisable in equal monthly installments over the four-year period following the vesting commencement date until fully vested at the fourth anniversary of the vesting commencement date, subject to the individual’s continued service through each vesting date. In addition, the employment agreements with our NEOs provide for accelerated vesting under certain circumstances. For additional discussion, please see “—Employment Agreements with Our Named Executive Officers” above. (2)Market value is calculated by multiplying the number of RSU or PSU stock awards that have not vested by the closing price of our common stock on December 29, 2023, the last trading day of 2023, which was $9.05.

The following table sets forth information regarding option exercises that vested during

____________________ (1)The amount shown for value realized on exercise of stock options equals (a) the number of shares of our common stock to which the exercise of the stock option related, multiplied by (b) the difference between the per-share market price of the shares on the date of exercise and the per-share exercise price of the option. If the stock acquired upon exercise was sold on the day of exercise, the market price was determined as the actual sales price of the stock. If the stock acquired upon exercise was not sold on the day of exercise, the market price was determined as the closing price of the stock on the Nasdaq Stock Market on the exercise date.

The following table summarizes the potential payments to our named executive officers in the scenarios listed in the table below. The table assumes that the termination of employment or change in control, as applicable, occurred on December 31, 41 vesting of option awards was computed using

____________________ (1)Represents cash severance payable upon an involuntary termination without cause or a resignation for good reason pursuant to the NEOs’ employment agreements. For Ms. Boyce, represents 12 months’ base salary (increased to 18 months’ base salary and full target bonus in the event of such a termination within 59 days prior to or 12 months following a change in control). For the other NEOs, represents 12 months’ base salary (plus full target bonus in the event of such a termination within 59 days prior to or 12 months following a change in control). (2)These values are based on the fair market value of our common stock of $9.05 on December 29, 2023, the last trading day of 2023. In the case of accelerated options, the value represents the excess of such fair market value over the exercise price of the unvested options, multiplied by the number of shares of common stock underlying such unvested options, the vesting of which accelerates in connection with the specified event. In the event of an involuntary termination without cause or a resignation for good reason within 59 days prior to or 12 months following a change in control, all outstanding unvested time-based vesting option awards held by the NEOs will vest upon such termination. In the case of unvested RSU and PSU awards, the value represents the number of shares of common stock underlying the unvested RSU and PSU awards, multiplied by the fair market value described above, the vesting of which accelerates in connection with the specified event. (3)Represents the value of the continuation of health benefits for the period corresponding to the period for which the NEO will receive cash severance benefits following the date of the named executive officer’s termination. 42

The Company’s principal executive officer ("PEO") and our NEOs not including our PEO were as follows for the fiscal years ended December 31, 2023, 2022, 2021 and 2020:

The following table sets forth information concerning the compensation of our PEO and non-PEO NEOs for the fiscal years ended December 31, 2023, 2022, 2021 and 2020, and our financial performance for each such fiscal year:

(1)Amounts represent compensation actually paid ("CAP") to our PEO and the average compensation actually paid to our non-PEO NEOs for the relevant fiscal year, as determined under SEC rules (and described below). (2)Fair value or change in fair value, as applicable, of stock options in the “Compensation Actually Paid” columns was estimated using a Black-Scholes option pricing model for the purposes of this disclosure in accordance with SEC rules and do not reflect compensation actually earned, realized or received during each applicable year. The calculation of CAP for purposes of this table includes point-in-time fair values of equity awards and these values will fluctuate based on our stock price and various accounting valuation assumptions. See the Summary Compensation Table for certain other compensation of our PEO and our non-PEO NEOs for each applicable fiscal year. Further, fair value of RSU and PSU awards held by the NEOs is based on market price of the Company's common stock. (3)For the relevant fiscal year, represents our cumulative TSR or the cumulative TSR of the Nasdaq Biotechnology Index, in each case assuming an initial investment of $100 as described under the Narrative Disclosure to Pay Versus Performance heading below. We have never declared or paid a dividend on our common stock and do not anticipate doing so in the foreseeable future. In the table immediately above, the columns entitled "Compensation Actually Paid to PEO" and "Average Compensation Actually Paid to non-PEO NEOs" reflect the Total Compensation reported in the 2023 Summary Compensation Table ("SCT") under the "Compensation Tables" section of this proxy statement, as adjusted based on the following: 43

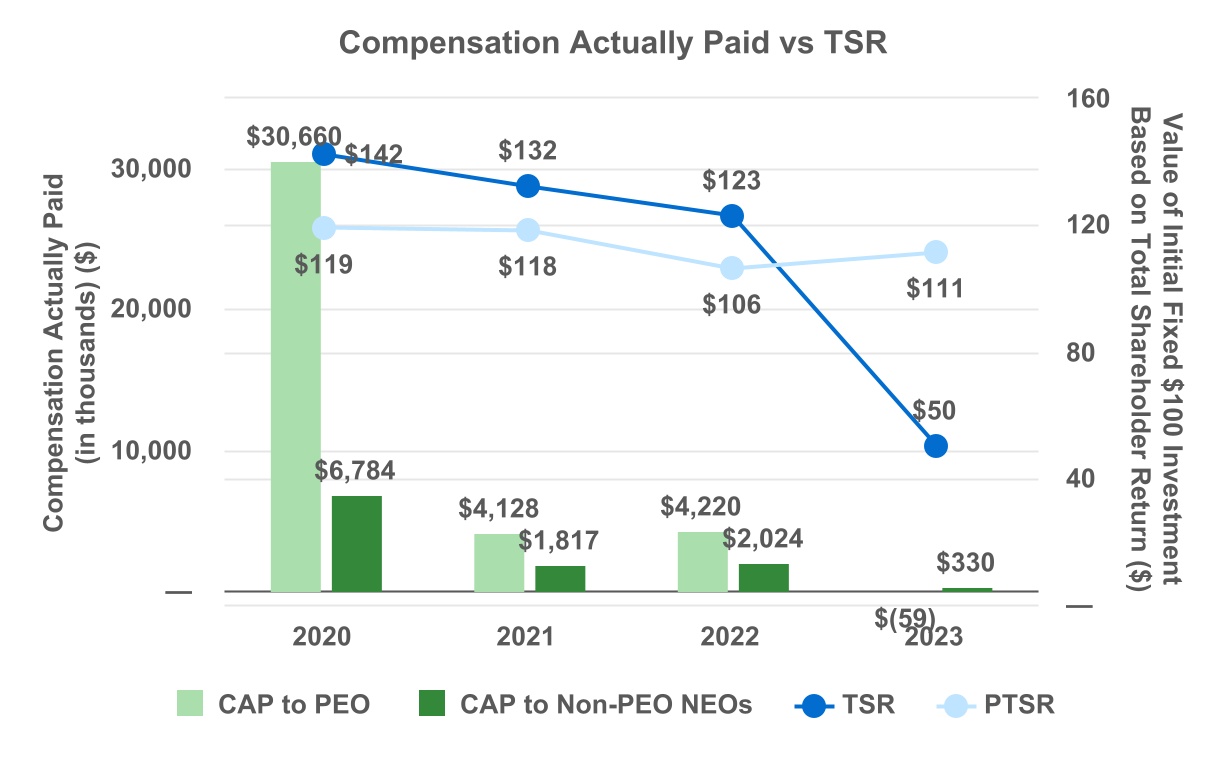

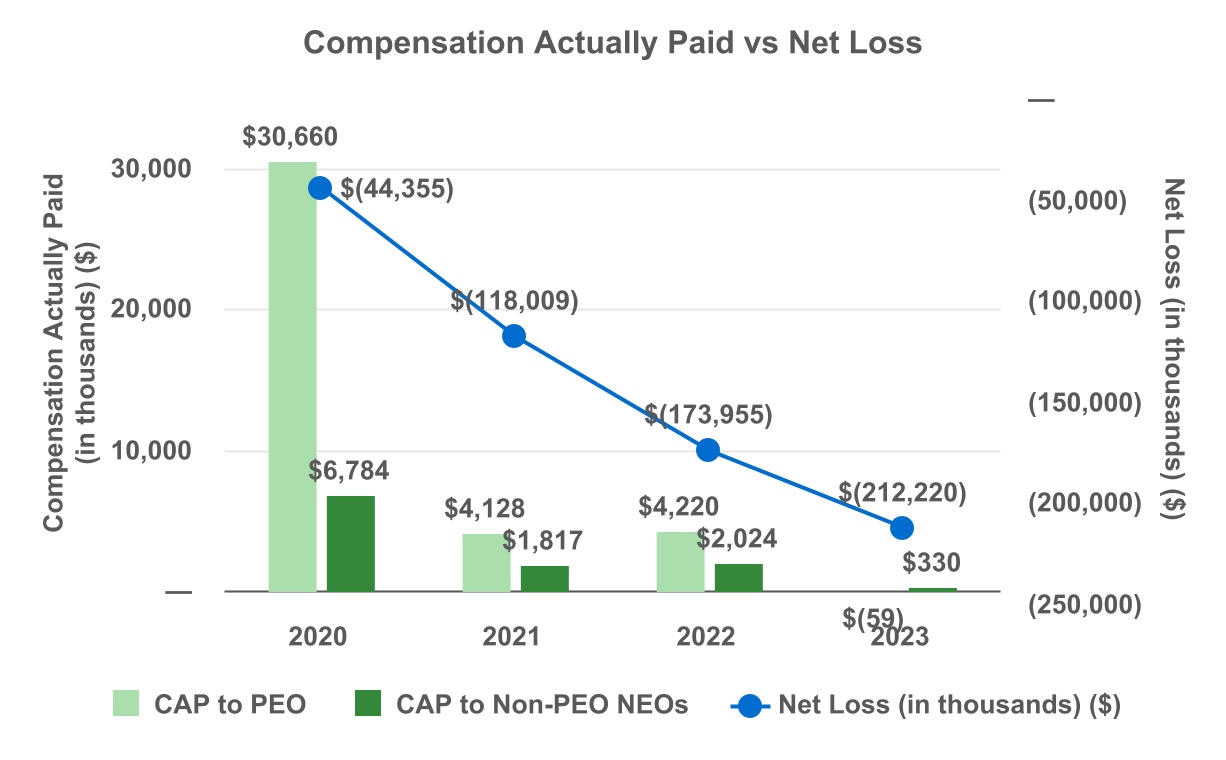

Narrative Disclosure to Pay Versus Performance Table Relationship Between Financial Performance Measures The graphs below compare the compensation actually paid to our PEO and the average of the compensation actually paid to our non-PEO NEOs, with (i) our cumulative TSR, (ii) our Peer Group TSR, and (iii) our net loss, in each case, for the fiscal years ended December 31, 2023, 2022, 2021 and 2020. TSR amounts reported in the graph assume an initial fixed investment of $100 on June 12, 2020 (the date our common stock commenced trading on the Nasdaq Global Market) and, with respect to our cumulative TSR, based on the opening trading price of $18.00 per share on such date, and that all dividends, if any, were reinvested. We have never declared or paid a dividend on our common stock and do not anticipate doing so in the foreseeable future.  44  The Company does not use net loss to determine compensation levels or incentive plan payouts, therefore the PEO and non-PEO NEOs CAP does not fluctuate with changes to net loss. No Financial Performance Measures Used in Setting Executive Compensation The Company does not use any financial performance measures in determining executive compensation, other than stock price, given that the value to be delivered pursuant to the equity awards granted to our named executive officers is dependent on our future stock price. Pursuant to SEC guidance, stock price is not

For 2023, the annual total compensation of our median employee, excluding Ms. Boyce, was $224,701, and the annual total compensation of Ms. Boyce, was $11,139,719. The ratio of these amounts is 50 to 1. To identify our median employee, we used a consistently applied compensation measure (“CACM”) to all employees as of December 31, 2023, including full time, part-time, regular and temporary employees, and excluding Ms. Boyce. Our CACM consisted of the sum of (i) annual base salary, (ii) cash bonus or incentive paid in 2022 and (iii) grant date fair value of equity awards granted in 2023, as obtained from our payroll and equity systems. Other than annualizing base salaries for permanent employees who were on a leave of absence or not employed for the full year as permitted under Item 402(u) of Regulation S-K, we did not make any compensation adjustments, whether for cost of living or otherwise, in the identification process. The median employee’s annual total compensation for fiscal 2023 was determined using the same methodology used to determine Ms. Boyce’s annual total compensation set forth in the “Summary Compensation Table” on page 34 of this proxy statement. The pay ratio reported above is a reasonable estimate calculated in a manner consistent with Item 402(u) of Regulation S-K under the Exchange Act. SEC regulations permit companies to adopt a variety of methodologies, apply certain exclusions and to make reasonable estimates and assumptions that reflect their compensation practices and other factors unique to their workforce and business operations when calculating their pay ratio. Therefore, the pay ratio reported by other companies may not be comparable to the pay ratio reported above. 45 Table of Contents

Our non-employee director compensation program (the “Director Compensation Program”) is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders. Directors who are also employees of our Company do not receive compensation for their service on the Board. We have reimbursed, and will continue to reimburse, our non-employee directors for their actual out-of-pocket costs and expenses incurred in connection with attending Under the Director Compensation Program, non-employee directors receive a cash retainer for service on the Board and for service on each committee of which the director is a member. The

In addition, under In In April 2024, after consultation with Alpine regarding director compensation relative to the market and the Company's peer group, the Board, upon recommendation from the Human Capital Management Committee, resolved to increase the Initial Director Grant to an option to purchase 55,000 shares and each Annual Director grant to an option to purchase 27,500 shares (subject to the caps on the grant date value of each Initial Director Grant and each Annual Director Grant of $750,000 and $375,000, respectively, as described above). All equity awards granted to our non-employee directors under the Director Compensation Program will vest upon a change of control

46 The following table sets forth information regarding the compensation of our non-employee directors earned for services rendered during the year ended December 31,

Table.” Eric Mosbrooker served as a director until his resignation on December 31, 2023.

____________________ (1)Represents the grant date fair value of option awards granted in 2023. In accordance with SEC rules, this column reflects the aggregate fair value of the awards granted to the directors computed as of the applicable grant date in accordance with ASC 718. Assumptions used in the calculation of these amounts are included in Notes 2 and 8 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 28, 2024. This amount does not reflect the actual economic value that will be realized by the directors upon the vesting or exercise of the awards or the sale of the common stock underlying such awards. The aggregate number of shares subject to stock options outstanding at December 31,

The following table sets forth information as of December 31, 47 Inc. 2022 Employment Inducement Incentive Award Plan (the "Inducement Plan"), and the Avidity Biosciences, Inc. 2020 Employee Stock Purchase Plan (the “2020 ESPP”).

____________________ (1)Includes 11,251,834 outstanding options to purchase shares of common stock and RSUs under the 2020 Plan and 1,989,057 outstanding options to purchase shares of common stock under the 2013 Plan. (2)Represents the weighted-average exercise price of outstanding options. (3)Includes 499,402 shares of common stock available for issuance under the 2020 Plan and 372,517 shares of common stock available for issuance under the 2020 ESPP (all of which were eligible for purchase pursuant to the offering period in effect on December 31, 2023). This amount does not (4)Represents shares of common stock available for issuance under the Inducement Plan. The material features of our equity

The following table and accompanying footnotes set forth certain information with respect to the beneficial ownership of our common stock at April •each of our directors; •each of our Named Executive Officers; •all of our current directors and executive officers as a group; and •each person, or group of affiliated persons, who beneficially owned more than 5% of our outstanding common stock. We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole voting and sole investment power with respect to all shares of common stock that they beneficially owned, subject to applicable community property laws. Applicable percentage ownership is based on not deem these shares outstanding, however, for the purpose of computing the percentage ownership of 48 any other person. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Avidity Biosciences, Inc., 10578 Science Center Drive, Suite 125, San Diego, California 92121.